News

CBAM Regulation in a Nutshell for Fastener Business Owners

Add to my favorite

2024-01-23

For those who struggle with the daunting length of CBAM regulation in full text, Fastener World editors have gone through all 53 pages of the regulation, and extracted the essential parts into a brief article for fastener business owners. This article will get you familiar with at least 80% of the core context of CBAM, and help you get into the swing of it.

The editors have slightly simplified abstruse statements in the regulation and cut out repetitive and redundant words and phrases to make it easier to read. Without further ado, here are the key CBAM excerpts.

Regulation (EU) 2023/956 of The European Parliament and of the Council (10 May 2023)

Critical Definitions

- ‘Direct emissions’ means emissions from the production processes of goods, including emissions from the production of heating and cooling that is consumed during the production processes, irrespective of the location of the production of the heating or cooling. For 7318 – screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, carbon dioxide washers (including spring washers) and similar articles of iron or steel, only direct emissions are to be taken into account.

- ‘Indirect emissions’ means emissions from the production of electricity which is consumed during the production processes of goods, irrespective of the location of the production of the consumed electricity.

- ‘Embedded emissions’ means direct emissions released during the production of goods and indirect emissions from the production of electricity that is consumed during the production processes. The authorized CBAM declarant shall keep records of the information required to calculate the embedded emissions until the end of the fourth year after the year in which the CBAM declaration has been or should have been submitted.

- ‘Actual emissions’ means the emissions calculated based on primary data from the production processes of goods and from the production of electricity consumed during those processes.

- ‘Ton of CO2e’ means one metric ton of CO2.

- ‘CBAM certificate’ means a certificate in electronic format corresponding to one ton of CO2e of embedded emissions in goods.

- ‘Surrender’ means offsetting of CBAM certificates against the declared embedded emissions in imported goods or against the embedded emissions in imported goods that should have been declared.

- ‘Default value’ means a value calculated or drawn from secondary data, which represents the embedded emissions in goods. When actual emissions cannot be adequately determined by the authorized CBAM declarant, default values shall be used. When reliable data for the exporting country cannot be applied for a type of goods, the default values shall be based on the average emission intensity of the X % worst performing EU ETS installations for that type of goods.

- ‘Carbon price’ means the monetary amount paid in a third country, under a carbon emissions reduction scheme, in the form of a tax, levy or fee or in the form of emission allowances under a greenhouse gas emissions trading system, calculated on greenhouse gases covered by such a measure, and released during the production of goods.

- ‘Installation’ means a stationary technical unit where a production process is carried out.

- ‘Operator’ means any person who operates or controls an installation in a third country.

- ‘National accreditation body’ is appointed by each Member State.

Obligations and Rights of Authorized CBAM Declarants

- Goods shall be imported into the customs territory of the Union only by an authorized CBAM declarant.

- Any importer established in a Member State shall, prior to importing goods into the customs territory of the Union, apply for the status of authorized CBAM declarant.

- Where an importer is not established in a Member State, the indirect customs representative shall submit the application for an authorization.

- The application for an authorization shall include the following information about the applicant:

(a) Name, address and contact information; (b) EORI number; (c) Main economic activity carried out in the Union; (d) Certification by the tax authority in the Member State where the applicant is established that the applicant is not subject to an outstanding recovery order for national tax debts; (e) Declaration that the applicant was not involved in any serious infringements or repeated infringements of customs legislation, taxation rules or market abuse rules during the five years preceding the year of the application, including that it has no record of serious criminal offences relating to its economic activity; (f) Information necessary to demonstrate the applicant’s financial and operational capacity to fulfil its obligations; (g) Estimated monetary value and volume of imports of goods into the customs territory of the Union by type of goods, for the calendar year during which the application is submitted, and for the following calendar year; (h) Names and contact information of the persons on behalf of whom the applicant is acting, if applicable.

- The applicant may withdraw its application at any time.

CBAM Declaration

- By 31 May of each year, and for the first time in 2027 for the year 2026, each authorized CBAM declarant shall use the CBAM registry to submit a CBAM declaration for the preceding calendar year.

- The CBAM declaration shall contain the following information:

- Total quantity of each type of goods imported during the preceding calendar year, expressed in megawatt-hours for electricity and in tons for other goods;

- Total embedded emissions in the goods, expressed in tons of CO2e emissions per megawatt-hour of electricity or, for other goods, in tons of CO2e emissions per ton of each type of goods;

- Total number of CBAM certificates to be surrendered;

- Copies of verification reports, issued by accredited verifiers.

Carbon Price Paid in a Third Country

- An authorized CBAM declarant may claim in the CBAM declaration a reduction in the number of CBAM certificates to be surrendered in order to take into account the carbon price paid in the country of origin for the declared embedded emissions. The reduction may be claimed only if the carbon price has been effectively paid in the country of origin. In such a case, any rebate or other form of compensation available in that country that would have resulted in a reduction of that carbon price shall be taken into account.

- The authorized CBAM declarant shall keep records of the documentation required to demonstrate that the declared embedded emissions were subject to a carbon price in the country of origin of the goods that has been effectively paid. The authorized CBAM declarant shall in particular keep evidence related to any rebate or other form of compensation available, in particular the references to the relevant legislation of that country. The information contained in that documentation shall be certified by a person that is independent from the authorized CBAM declarant and from the authorities of the country of origin. The name and contact information of that independent person shall appear on the documentation. The authorized CBAM declarant shall also keep evidence of the actual payment of the carbon price until the end of the fourth year after the year during which the CBAM declaration has been or should have been submitted.

Registration of Operators and of Installations in Third Countries

- The request for registration shall contain the following information to be included in the CBAM registry upon registration:

- the name, address and contact information of the operator;

- the location of each installation including the complete address and geographical coordinates expressed in longitude and latitude, including six decimals;

- the main economic activity of the installation.

- The Commission shall notify the operator of the registration in the CBAM registry. The registration shall be valid for a period of five years from the date of its notification to the operator of the installation.

- The operator may, at any time, ask to be deregistered from the CBAM registry. The Commission shall, upon such request, and after notifying the competent authorities, deregister the operator and delete the information on that operator and on its installation from the CBAM registry.

Professional Secrecy and Disclosure of Information

- All information acquired by the competent authority or the Commission in the course of performing their duties which is by its nature confidential or which is provided on a confidential basis shall be covered by the obligation of professional secrecy. Such information shall not be disclosed by the competent authority or the Commission without the express prior permission of the person or authority that provided it or by virtue of Union or national law.

- By way of derogation from paragraph 1, the competent authorities and the Commission may share such information with each other, the customs authorities, the authorities in charge of administrative or criminal penalties, and the European Public Prosecutor’s Office, for the purposes of ensuring compliance of persons with their obligations under this Regulation and the application of customs legislation. Such shared information shall be covered by professional secrecy and shall not be disclosed to any other person or authority except by virtue of Union or national law.

Accreditation of Verifiers

A national accreditation body may, on request, accredit a person to be a verifier for the purpose of this Regulation.

Review of CBAM Declarations

1. The Commission may review CBAM declarations, in accordance with a review strategy, including risk factors, within the period ending with the fourth year after the year during which the CBAM declarations should have been submitted.

2. Where the competent authority concludes that the declared number of CBAM certificates to be surrendered is incorrect, it shall determine the number of CBAM certificates which should have been surrendered by the authorized CBAM declarant, taking into account the information submitted by the Commission. The competent authority shall notify the authorized CBAM declarant of its decision on the number of CBAM certificates determined and shall request that the authorized CBAM declarant surrender the additional CBAM certificates within one month.

3. Where the competent authority concludes that the number of CBAM certificates surrendered exceeds the number which should have been surrendered, it shall inform the Commission without delay. The CBAM certificates surrendered in excess shall be repurchased.

Sale of CBAM Certificates

1. A Member State shall sell CBAM certificates on a common central platform to authorized CBAM declarants established in that Member State.

2. The Commission shall ensure that each CBAM certificate is assigned a unique identification number upon its creation. The Commission shall register the unique identification number and the price and date of sale of the CBAM certificate in the CBAM registry in the account of the authorized CBAM declarant purchasing that certificate.

Price of CBAM Certificates

1. The Commission shall calculate the price of CBAM certificates as the average of the closing prices of EU ETS allowances on the auction platform, in accordance with the procedures, for each calendar week. For those calendar weeks in which no auctions are scheduled on the auction platform, the price of CBAM certificates shall be the average of the closing prices of EU ETS allowances of the last week in which auctions on the auction platform took place.

2. The Commission shall publish the average price on its website or in any other appropriate manner on the first working day of the following calendar week. That price shall apply from the first working day following that of its publication to the first working day of the following calendar week.

Surrender of CBAM Certificates

1. By 31 May of each year, and for the first time in 2027 for the year 2026, the authorized CBAM declarant shall surrender via the CBAM registry a number of CBAM certificates that corresponds to the embedded emissions declared for the calendar year preceding the surrender. The authorized CBAM declarant shall ensure that the required number of CBAM certificates is available on its account in the CBAM registry.

2. The authorized CBAM declarant shall ensure that the number of CBAM certificates on its account in the CBAM registry at the end of each quarter corresponds to at least 80 % of the embedded emissions in all goods it has imported since the beginning of the calendar year.

Repurchase of CBAM Certificates

1. Where an authorized CBAM declarant so requests, the Member State where that authorized CBAM declarant is established shall repurchase the excess CBAM certificates remaining on the account of the declarant in the CBAM registry after the certificates have been surrendered. The Commission shall repurchase the excess CBAM certificates through the common central platform on behalf of the Member State where the authorized CBAM declarant is established. The authorized CBAM declarant shall submit the repurchase request by 30 June of each year during which CBAM certificates were surrendered.

2. The number of certificates subject to repurchase shall be limited to one third of the total number of CBAM certificates purchased by the authorized CBAM declarant during the previous calendar year.

3. The repurchase price for each CBAM certificate shall be the price paid by the authorized CBAM declarant for that certificate at the time of purchase.

Rules Applicable to the Importation of Goods

1. The customs authorities shall not allow the importation of goods by any person other than an authorized CBAM declarant.

2. The customs authorities may communicate confidential information acquired by the customs authorities in the course of performing their duties, or provided to the customs authorities on a confidential basis, to the Commission and the competent authority of the Member State that has granted the status of the authorized CBAM declarant.

Penalties

1. An authorized CBAM declarant who fails to surrender, by 31 May of each year, the number of CBAM certificates that corresponds to the emissions embedded in goods imported during the preceding calendar year shall be held liable for the payment of a penalty. Such a penalty shall be applicable in the year of importation of the goods.

2. Where a person other than an authorized CBAM declarant introduces goods into the customs territory of the Union without complying with the obligations under this Regulation, that person shall be held liable for the payment of a penalty. Such a penalty shall be an amount from three to five times the penalty referred to in paragraph 1. The payment of the penalty shall not release the authorized CBAM declarant from the obligation to surrender the outstanding number of CBAM certificates in a given year.

Circumvention

Practices of circumvention shall be defined as a change in the pattern of trade in goods, which stems from a practice, process or work which may consist of, but is not limited to:

(a) Slightly modifying the goods concerned to make those goods fall under CN codes which are not listed, except where the modification alters their essential characteristics; (b) Artificially splitting shipments into consignments the intrinsic value of which does not exceed the threshold.

Scope of the Transitional Period

During the transitional period from 1 October 2023 until 31 December 2025, where the importer is established in a Member State and appoints an indirect customs representative, and where the indirect customs representative so agrees, the reporting obligations shall apply to such indirect customs representative. Where the importer is not established in a Member State, the reporting obligations shall apply to the indirect customs representative.

That's a Wrap

There you go. Fastener World keep tabs on CBAM and for latest updates, check out www.fastener-world.com and our publications.

Latest Update:

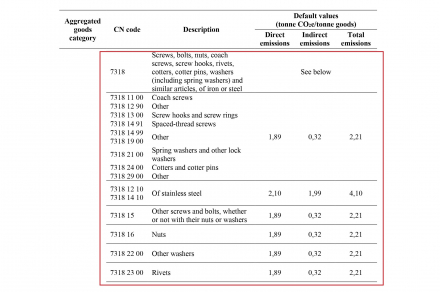

Commission publishes default values for determining embedded emissions during the CBAM transitional period and updated guidance on reporting obligations

On 22 December 2023, the Commission published the default values that can be used to determine embedded emissions in imported goods (except electricity) covered by Carbon Border Adjustment Mechanism (CBAM) during its transitional period which lasts until the end of 2025.

Default values play a specific role in CBAM implementation during the transitional period, in particular when importers do not have all the necessary information:

- During the three first quarterly reports (Q4 of 2023 and Q1&2 of 2024), declarants may report embedded emission based on default values made available and published by the European Commission without quantitative limit;

- From Q3 of 2024 and until the end of 2025, declarants can still report emissions based on estimations but only for complex goods and with a limit of 20% of the total embedded emissions. Using default values would qualify as ‘estimation’.

These default values will be revised regularly after the end of the first reporting period for Q4 of 2023 (to be submitted by 31 January 2024), to take into account data collected in that first reporting period as well as feedback from EU industry and from non-EU producers of CBAM goods.

Besides the flexibilities foreseen in the CBAM regulation and in its implementing regulation for the transitional period, additional simplifications or facilities have been integrated or will be integrated soon in the online dedicated reporting tool, the CBAM transitional registry. These include:

- An option for recording emission data of a specific good to be reused in subsequent reports (feasible from the second quarterly report in April 2024);

- An option for reconducting the previous report updating the imported quantities;

- An option for reporting data based on an XML file to allow reporting declarants to automatise their own process to reuse previous reports data whenever appropriate;

- Clarification that for operators, the default reporting period is twelve months to allow them to collect representative data that reflects an installation’s annual operations. The twelve-month reporting period may be either a calendar year or alternatively a fiscal year. However, operators may also choose an alternative reporting period of a least three months if the installation participates in an eligible MRV system and the reporting period coincides with the requirements of that MRV system.

The Commission will continue working on further simplifying reporting obligations and how to facilitate the submission of certain business data directly from the non-EU producers to the CBAM Registry before the second reporting period in 2024. The European Commission has also updated two written guidance documents to help importers and installation operators outside the EU to navigate the transitional period (1 October 2023 – 31 December 2025) with the reporting obligations.

The guidance documents are updated with clarifications and corrections especially for the timeline for the reporting periods, and quality of information in the CBAM reports e.g. information to be submitted for inward processing and production routes. The guidance documents are accompanied by an electronic template for information that may be used by installation operators to communicate information on the embedded emissions of their goods to the reporting declarants.

Background

CBAM is the EU's landmark tool to fight carbon leakage and one of the central pillars of the EU's ambitious Fit for 55 Agenda. CBAM has two goals: to contribute to the EU achieving its ambitious climate policies and to encourage industry worldwide to embrace greener technologies, particularly in countries with less ambitious green standards.

In its transitional phase, CBAM will only apply to imports of cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. EU importers of those goods will have to report on the volume of their imports and the greenhouse gas (GHG) emissions embedded during their production, but without paying any financial adjustment at this stage.

The objective of the transitional period is to serve as a pilot and learning period for all stakeholders (importers, producers and authorities) and to collect useful information on embedded emissions to refine the methodology for the definitive period. In a report in mid-2025, the Commission will draw the lessons of the transitional period from that information to refine the mechanism’s scope and the methodologies for calculating embedded emissions before CBAM payments begin in 2026.

While importers are asked to collect data as of the fourth quarter of 2023, their first report will only have to be submitted by 31 January 2024 at the latest. These reports can be amended until 31 July 2024.

The Implementing Regulation on reporting requirements and methodology provides for some flexibility when it comes to the values used to calculate embedded emissions on imports during the transitional phase.

Until the end of 2024, companies will have the choice of reporting in three ways:

- full reporting according to the new methodology (EU method);

- reporting based on an equivalent method (three options) and

- reporting based on default reference values (only until July 2024, i.e for Q4 of 2023 and Q1&Q2 of 2024)

As of 1 January 2025, only the EU method will be accepted.

Download document:

Default values for the transitional period of the CBAM between 1 October 2023 and 31 December 2025(Fasteners default values are listed in page 14)

扣件

國際展會

惠達雜誌

匯達實業

外銷媒合

廣告刊登

螺絲五金

五金工具

紧固件

台灣扣件展

印度新德里螺絲展

越南河內螺絲展

墨西哥瓜達拉哈拉螺絲展

美國拉斯維加斯螺絲暨機械設備展

波蘭克拉科夫螺絲展

義大利米蘭螺絲展

德國司徒加特螺絲展

FAIR INDIA

FASTENER FAIR VIETNAM

FASTENER FAIR MEXICO

FASTENER POLAND

FASTENER FAIR ITALY

FASTENER FAIR GLOBAL

FASTENER WORLD

READ NEXT

Subscribe