GOVERNMENTS/ASSOCIATIONS/FASTENER GROUPS

Taiwan MOE Announces Determination of Domestic Carbon Price Rates

Add to my favorite

2024-10-29

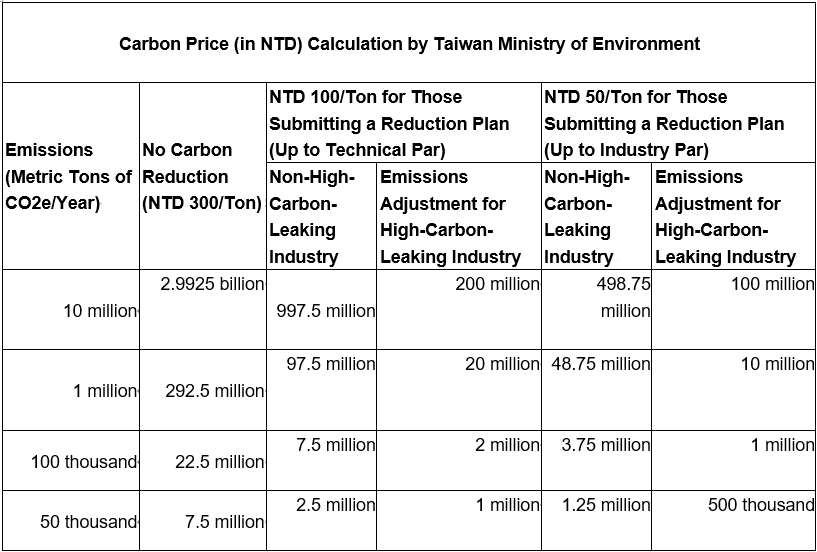

Taiwan Ministry of Environment (MOE) announced a consensus on the carbon price on October 7. The review committee determines that the general rate is NTD 300/ton, which will be increased to NTD 1,200-1,800 in 2030. Preferential rates may be applied to businesses that propose independent reduction plans. The preferential rates are NTD 50 or NTD 100 depending on specified requirements. In addition, businesses with high carbon leakage risks can multiply the price by the "emission adjustment coefficient" of 0.2, which will result in the minimum carbon price being only NTD 10/ton. The charges are applicable to the electricity, gas supply and manufacturing industries whose annual greenhouse gas emissions exceed 25,000 metric tons of CO2 equivalent. In the first phase, there are about 281 companies subject to carbon price collection. MOE has calculated and found that if all carbon price levy targets can propose independent reduction plans, the carbon emissions will be reduced by 14% in 2030 compared with 2005, while Taiwan's Nationally Determined Contribution (NDC) target for 2030 is 23%-25%.

MOE stated the next step is to pre-announce a draft bill for carbon price rates, which is expected to take effect on New Year's Day in 2025. There will be future measures to increase carbon inventory scope as well as the levy targets. Calculation based on a preferential rate of NTD 100 translates to a carbon price income of NTD 6 billion in 2026, which will be used for practical reduction efforts, adaptation to climate change, administrative implementation and other work. If a manufacturer with annual emissions of 10 million tons does not propose a voluntary reduction plan, it will have to pay NTD 2.99 billion per year; if it submits the plan and multiplies the emissions by the high carbon leakage risk coefficient of 0.2, it will only have to pay a minimal NTD 1 million. Environment protection advocates issued a statement of criticism, asking that the preferential rates be phased out after 2030.

Starting next year, MOE will follow the EU's practice and require imported similar products to declare emission coefficients. MOE will also start planning Taiwan's own CBAM.

MOE stated the next step is to pre-announce a draft bill for carbon price rates, which is expected to take effect on New Year's Day in 2025. There will be future measures to increase carbon inventory scope as well as the levy targets. Calculation based on a preferential rate of NTD 100 translates to a carbon price income of NTD 6 billion in 2026, which will be used for practical reduction efforts, adaptation to climate change, administrative implementation and other work. If a manufacturer with annual emissions of 10 million tons does not propose a voluntary reduction plan, it will have to pay NTD 2.99 billion per year; if it submits the plan and multiplies the emissions by the high carbon leakage risk coefficient of 0.2, it will only have to pay a minimal NTD 1 million. Environment protection advocates issued a statement of criticism, asking that the preferential rates be phased out after 2030.

Starting next year, MOE will follow the EU's practice and require imported similar products to declare emission coefficients. MOE will also start planning Taiwan's own CBAM.

According to the calculation by MOE, a company at an annual emission level of 10 million tons of CO2e with no carbon reduction measures will be charged a carbon price of NTD 300/ton, and deducting the exemption quota (25,000 metric tons which translate to a deductible value of NTD 7.5 million), the company will eventually pay NTD 2.9925 billion. For a non-high-carbon-leaking company which has submitted an independent reduction plan that meets the designated reduction targets (up to technical par), a preferential rate (NTD 100/ton) can be applied, and the carbon price is reduced to NTD 997.5 million, just one-third of the price for companies without carbon reduction measures. Going further, by choosing the industry-specific target (up to industry par, namely the highest in international standards) an even lower price rate of NTD 50/ton can be applied, leading to a carbon price down to NTD 498.75 million.

For high-carbon-leaking industries such as steel and cement, the price is calculated as follows: Emissions x Emission Adjustment Coefficient Value x Preferential Rate. The emission adjustment coefficient value will be 0.2, 0.4, and 0.6 respectively in the first to third phase, gradually going downward. For a non-high-carbon-leaking company with annual emission of 10 million tons of CO2e, by submitting an independent reduction plan that meets the specified reduction targets (up to technical par), a preferential rate of NTD 100/ton can be applied, and the carbon price is down to NTD 200 million (10 million x 0.2 x NTD 100= NTD 2 million). By choosing the industry-specific target (up to industry par), a preferential rate of NTD 50/ton can be applied, and the carbon price is down to NTD 100 million (10 million x 0.2 x NTD 50= NTD 1 million).

台灣環境部

碳費

碳盤查計算公式

審議會

碳排

CBAM

Taiwan MOE

carbon price

calculation formula

review committee

carbon emission

德國杜塞道夫線材展

扣件

國際展會

惠達雜誌

匯達實業

外銷媒合

廣告刊登

螺絲五金

五金工具

緊固件

台灣扣件展

印度新德里螺絲展

越南河內螺絲展

墨西哥瓜達拉哈拉螺絲展

美國拉斯維加斯螺絲暨機械設備展

波蘭克拉科夫螺絲展

義大利米蘭螺絲展

德國司徒加特螺絲展

wire Dusseldorf

FASTENER FAIR INDIA

FASTENER FAIR VIETNAM

FASTENER FAIR MEXICO

FASTENER POLAND

FASTENER FAIR ITALY

FASTENER FAIR GLOBAL

READ NEXT

Subscribe